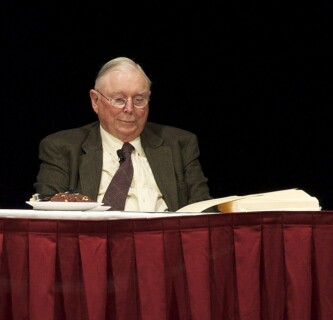

People are paying their respects to Charlie Munger, who was a close friend of famous investor Warren Buffett. Munger passed away at the age of 99 and would have turned 100 on January 1st. He had been a vice chairman at Berkshire Hathaway since 1978. Buffett says that Munger played a big part in making Berkshire Hathaway successful, which is now worth $785 billion. Munger was known for being honest and straightforward, and he would point out mistakes when he saw them. He died not long after Buffett donated a lot of Berkshire stock to charity and hinted that he might retire in the future. Shareholders at Berkshire’s annual gathering in May will miss Munger’s interesting quotes and honest comments.

Munger was well-respected in the investment community, and many people learned from his wisdom. He was known for helping Buffett avoid investing in bad companies and instead focusing on good ones. Munger was worth about $2.3 billion, which is a lot less than Buffett’s estimated $100 billion. His death marks the end of an important time for Berkshire Hathaway, but the company has already chosen Greg Abel to take over from Buffett.

Many important people in the business world have paid tribute to Munger. Tim Cook, the CEO of Apple, called him a “titan of business” and praised his role in building a great American company. Brian Moynihan, the CEO of Bank of America, also recognized Munger’s legendary status in the investment community and the big impact he had on others. People who were influenced by Munger’s wisdom and ideas will continue to remember and celebrate his legacy.

Original news source: Tributes pour in for investment guru Charlie Munger (BBC)

Listen

Slow

Normal

Fast

Group or Classroom Activities

Warm-up Activities:

– News Summary

Instructions:

1. Divide the students into pairs or small groups.

2. Give each group a copy of the article.

3. Ask the students to read the article and summarize the main points in their own words.

4. Have each group share their summary with the class.

– Opinion Poll

Instructions:

1. Divide the students into pairs.

2. Assign each pair a topic related to the article, such as “Charlie Munger’s influence on Berkshire Hathaway” or “The legacy of Charlie Munger.”

3. Instruct the pairs to come up with a question related to their assigned topic and create a short opinion poll.

4. Have the pairs go around the class and ask other students their opinions on their poll question.

5. After gathering the results, have each pair present their findings to the class.

– Vocabulary Pictionary

Instructions:

1. Choose 10-15 vocabulary words from the article, such as “respects,” “vice chairman,” “retire,” “investing,” etc.

2. Write each word on separate pieces of paper or index cards.

3. Divide the students into two teams.

4. One student from each team will come to the front of the class and choose a word without showing it to their team.

5. The student must then draw a picture representation of the word while their team tries to guess what it is.

6. The team that guesses correctly earns a point. Continue until all words have been used.

– Pros and Cons

Instructions:

1. Divide the students into pairs or small groups.

2. Assign each group the task of discussing the pros and cons of Charlie Munger’s contributions to Berkshire Hathaway.

3. Give the groups time to brainstorm and discuss their ideas.

4. Have each group present their findings to the class, encouraging a discussion and debate.

– Think-Pair-Share

Instructions:

1. Ask the students to think individually about one lesson they can learn from Charlie Munger’s life and career.

2. Pair the students up and have them share their thoughts with each other.

3. After the pairs have discussed, bring the class together and ask a few students to share their thoughts with the whole group.

4. Facilitate a class discussion on the lessons learned from Charlie Munger’s life and career.

Comprehension Questions:

1. Who was Charlie Munger and why are people paying their respects to him?

2. How long had Charlie Munger been a vice chairman at Berkshire Hathaway?

3. According to Warren Buffett, what role did Munger play in making Berkshire Hathaway successful?

4. How much is Berkshire Hathaway currently worth?

5. What were some of the characteristics that Munger was known for?

6. What did Buffett do shortly before Munger’s death?

7. Who has been chosen to take over from Buffett at Berkshire Hathaway?

8. Who are some of the important people in the business world who have paid tribute to Munger?

Go to answers ⇩

Listen and Fill in the Gaps:

People are paying their respects to Charlie Munger, who was a (1)______ friend of famous investor Warren (2)______. Munger passed away at the age of 99 and would have turned 100 on (3)______ 1st. He had been a vice chairman at Berkshire Hathaway since 1978. Buffett says that Munger played a big part in making Berkshire Hathaway successful, which is now (4)______ $785 billion. Munger was known for being honest and (5)______, and he would point out mistakes when he saw them. He died not long after Buffett donated a lot of Berkshire stock to (6)______ and hinted that he might retire in the future. Shareholders at Berkshire’s annual (7)______ in May will miss Munger’s interesting (8)______ and honest comments.

Munger was well-respected in the investment community, and many people learned from his wisdom. He was known for helping Buffett (9)______ investing in bad companies and instead focusing on good ones. Munger was worth about $2.3 billion, which is a lot less than Buffett’s estimated $100 billion. His (10)______ marks the end of an (11)______ time for Berkshire (12)______, but the company has already chosen Greg Abel to take over from Buffett.

Many important people in the business world have paid tribute to Munger. Tim Cook, the CEO of Apple, called him a “titan of business” and (13)______ his role in (14)______ a great American company. Brian Moynihan, the CEO of Bank of America, also recognized Munger’s legendary status in the (15)______ community and the big impact he had on others. People who were (16)______ by Munger’s wisdom and ideas will continue to remember and celebrate his legacy.

Go to answers ⇩

Discussion Questions:

Students can ask a partner these questions, or discuss them as a group.

1. What is Berkshire Hathaway and why is it worth so much money?

2. How do you think Warren Buffett feels about the passing of his close friend, Charlie Munger?

3. Do you think it’s important for a company to have honest and straightforward leaders? Why or why not?

4. How would you feel if you were given the opportunity to learn from someone as wise as Charlie Munger?

5. Do you think it’s better to focus on investing in good companies or avoiding bad ones? Why?

6. Why do you think Warren Buffett chose Greg Abel to take over from him at Berkshire Hathaway?

7. How do you think Tim Cook and Brian Moynihan felt about Charlie Munger’s contributions to the business world?

8. Do you think it’s important for successful people to give back to charity? Why or why not?

9. How do you think Charlie Munger’s wisdom and ideas will continue to impact future generations?

10. If you were a shareholder at Berkshire’s annual gathering, what interesting quotes or honest comments would you have liked to hear from Charlie Munger?

11. What qualities do you think are important for a successful investor to have, based on Charlie Munger’s legacy?

12. Do you think it’s more important to be respected or liked in the business world? Why or why not?

13. How do you think Charlie Munger’s passing will affect Berkshire Hathaway’s future?

14. Would you like to have a mentor like Charlie Munger? Why or why not?

15. How do you think Charlie Munger’s legacy will be remembered in the years to come?

Individual Activities

Vocabulary Meanings:

Match each word to its meaning.

Words:

1. respects

2. investor

3. successful

4. mistakes

5. wisdom

6. companies

7. tribute

8. legacy

Meanings:

(a) Errors or wrong actions

(b) Knowledge and good judgment gained through experience

(c) A gesture or action to show respect or admiration

(d) Showing admiration or honor for someone

(e) Something that is remembered or passed down

(f) Achieving a desired outcome or goal

(g) Organizations or businesses

(h) A person who puts money into something to make a profit

Go to answers ⇩

Multiple Choice Questions:

1. Who was Charlie Munger?

(a) The CEO of Apple

(b) The CEO of Bank of America

(c) A close friend of Warren Buffett

(d) A famous investor from Germany

2. How old was Charlie Munger when he passed away?

(a) 100

(b) 99

(c) 98

(d) 101

3. How long had Charlie Munger been a vice chairman at Berkshire Hathaway?

(a) Since 1985

(b) Since 1990

(c) Since 2000

(d) Since 1978

4. How much is Berkshire Hathaway currently worth?

(a) $785 billion

(b) $500 billion

(c) $1 trillion

(d) $1 billion

5. What was one of Charlie Munger’s notable characteristics?

(a) Being secretive and mysterious

(b) Being honest and straightforward

(c) Being indecisive and unsure

(d) Being aggressive and confrontational

6. What did Warren Buffett recently do with a lot of Berkshire stock?

(a) Sold it to another investor

(b) Gave it to Charlie Munger

(c) Donated it to charity

(d) Kept it for himself

7. Who has been chosen to take over from Warren Buffett at Berkshire Hathaway?

(a) Tim Cook

(b) Brian Moynihan

(c) Charlie Munger

(d) Greg Abel

8. How did Tim Cook, the CEO of Apple, describe Charlie Munger?

(a) A “titan of business”

(b) A “visionary leader”

(c) A “financial genius”

(d) A “mysterious figure”

Go to answers ⇩

True or False Questions:

1. Charlie Munger, a distant friend of Warren Buffett, passed away at the age of 89.

2. Greg Abel has been overlooked to take over from Buffett as Munger’s successor at Berkshire Hathaway.

3. Munger’s death came shortly after Buffett donated a large amount of Berkshire stock to charity and hinted at his own retirement.

4. Munger was worth about $2.3 billion, significantly less than Buffett’s estimated $100 billion.

5. Munger was a junior chairman at Berkshire Hathaway since 1978.

6. Munger was notorious for his dishonesty and evasiveness, seldom admitting to mistakes when he saw them.

7. Munger’s wisdom and guidance helped Buffett avoid investing in bad companies and focus on good ones.

8. Munger played a significant role in making Berkshire Hathaway successful, which is now worth $785 billion.

Go to answers ⇩

Write a Summary:

Write a summary of this news article in two sentences.

Check your writing now with the best free AI for English writing!

Writing Questions:

Answer the following questions. Write as much as you can for each answer.

Check your answers with our free English writing assistant!

1. Who was Charlie Munger and what was his role at Berkshire Hathaway?

2. How did Warren Buffett describe Munger’s contribution to Berkshire Hathaway’s success?

3. What was one of Munger’s notable qualities and how did he use it in his work?

4. How did Munger’s death coincide with a significant event in Buffett’s life?

5. Who are some important figures in the business world who paid tribute to Munger and what did they say about him?

Answers

Comprehension Question Answers:

1. Who was Charlie Munger and why are people paying their respects to him?

Charlie Munger was a close friend of Warren Buffett and a vice chairman at Berkshire Hathaway. People are paying their respects to him because he passed away at the age of 99 and had a big impact on the investment community.

2. How long had Charlie Munger been a vice chairman at Berkshire Hathaway?

Charlie Munger had been a vice chairman at Berkshire Hathaway since 1978.

3. According to Warren Buffett, what role did Munger play in making Berkshire Hathaway successful?

According to Warren Buffett, Munger played a big part in making Berkshire Hathaway successful.

4. How much is Berkshire Hathaway currently worth?

Berkshire Hathaway is currently worth $785 billion.

5. What were some of the characteristics that Munger was known for?

Munger was known for being honest, straightforward, and for pointing out mistakes when he saw them.

6. What did Buffett do shortly before Munger’s death?

Shortly before Munger’s death, Buffett donated a lot of Berkshire stock to charity and hinted that he might retire in the future.

7. Who has been chosen to take over from Buffett at Berkshire Hathaway?

Greg Abel has been chosen to take over from Buffett at Berkshire Hathaway.

8. Who are some of the important people in the business world who have paid tribute to Munger?

Some of the important people in the business world who have paid tribute to Munger include Tim Cook, the CEO of Apple, and Brian Moynihan, the CEO of Bank of America.

Go back to questions ⇧

Listen and Fill in the Gaps Answers:

(1) close

(2) Buffett

(3) January

(4) worth

(5) straightforward

(6) charity

(7) gathering

(8) quotes

(9) avoid

(10) death

(11) important

(12) Hathaway

(13) praised

(14) building

(15) investment

(16) influenced

Go back to questions ⇧

Vocabulary Meanings Answers:

1. respects

Answer: (d) Showing admiration or honor for someone

2. investor

Answer: (h) A person who puts money into something to make a profit

3. successful

Answer: (f) Achieving a desired outcome or goal

4. mistakes

Answer: (a) Errors or wrong actions

5. wisdom

Answer: (b) Knowledge and good judgment gained through experience

6. companies

Answer: (g) Organizations or businesses

7. tribute

Answer: (c) A gesture or action to show respect or admiration

8. legacy

Answer: (e) Something that is remembered or passed down

Go back to questions ⇧

Multiple Choice Answers:

1. Who was Charlie Munger?

Answer: (c) A close friend of Warren Buffett

2. How old was Charlie Munger when he passed away?

Answer: (b) 99

3. How long had Charlie Munger been a vice chairman at Berkshire Hathaway?

Answer: (d) Since 1978

4. How much is Berkshire Hathaway currently worth?

Answer: (a) $785 billion

5. What was one of Charlie Munger’s notable characteristics?

Answer: (b) Being honest and straightforward

6. What did Warren Buffett recently do with a lot of Berkshire stock?

Answer: (c) Donated it to charity

7. Who has been chosen to take over from Warren Buffett at Berkshire Hathaway?

Answer: (d) Greg Abel

8. How did Tim Cook, the CEO of Apple, describe Charlie Munger?

Answer: (a) A “titan of business”

Go back to questions ⇧

True or False Answers:

1. Charlie Munger, a distant friend of Warren Buffett, passed away at the age of 89. (Answer: False)

2. Greg Abel has been overlooked to take over from Buffett as Munger’s successor at Berkshire Hathaway. (Answer: False)

3. Munger’s death came shortly after Buffett donated a large amount of Berkshire stock to charity and hinted at his own retirement. (Answer: True)

4. Munger was worth about $2.3 billion, significantly less than Buffett’s estimated $100 billion. (Answer: True)

5. Munger was a junior chairman at Berkshire Hathaway since 1978. (Answer: False)

6. Munger was notorious for his dishonesty and evasiveness, seldom admitting to mistakes when he saw them. (Answer: False)

7. Munger’s wisdom and guidance helped Buffett avoid investing in bad companies and focus on good ones. (Answer: True)

8. Munger played a significant role in making Berkshire Hathaway successful, which is now worth $785 billion. (Answer: True)

Go back to questions ⇧