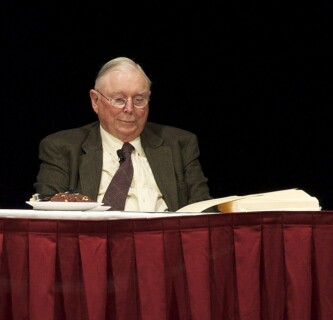

Tributes are pouring in for Charlie Munger, the trusted confidante of renowned investor Warren Buffett, who passed away at the age of 99. Munger, who would have turned 100 on January 1st, had been a vice chairman at Berkshire Hathaway since 1978. Buffett credits Munger with being instrumental in building Berkshire Hathaway into the successful investment company it is today, with a market valuation of $785 billion. Munger was known for his straightforward and honest approach, often pointing out mistakes when he saw them. His passing comes shortly after Buffett donated a significant amount of Berkshire stock to charity and hinted at the possibility of stepping down in the future. Munger’s colorful quotes and candid comments will be missed by shareholders at Berkshire’s annual gathering in May.

Munger’s contribution to the investment community is widely recognized, and his wisdom has benefited many. He was known for steering Buffett away from investing in mediocre companies, referred to as “cigar butts,” and instead focusing on quality investments. Munger’s fortune was estimated at $2.3 billion, significantly smaller than Buffett’s estimated fortune of over $100 billion. His passing marks the end of an era for Berkshire Hathaway, but the company has already named Greg Abel as Buffett’s successor.

Tributes have come from various figures in the business world, including Tim Cook, CEO of Apple, who described Munger as a “titan of business” and praised his role in building an American institution. Brian Moynihan, CEO of Bank of America, also acknowledged Munger’s legendary status in the investment community and the significant impact he had on others. Munger’s legacy will continue to be remembered and celebrated by those who were influenced by his wisdom and insights.

Original news source: Tributes pour in for investment guru Charlie Munger (BBC)

Listen

Slow

Normal

Fast

Group or Classroom Activities

Warm-up Activities:

– News Summary

Instructions: Have students read the article individually or in pairs and then write a summary of the main points. They should focus on capturing the key information, such as Charlie Munger’s role at Berkshire Hathaway, his influence on Warren Buffett, and his contributions to the investment community. After writing their summaries, students can share and compare their answers with a partner or the whole class.

– Opinion Poll

Instructions: Divide the class into small groups and ask them to discuss and share their opinions on the following questions:

1. What do you think was Charlie Munger’s most significant contribution to Berkshire Hathaway?

2. What qualities do you think made Munger an effective partner for Warren Buffett?

3. How do you think Munger’s passing will impact Berkshire Hathaway’s future?

After discussing their opinions, each group can present their answers to the whole class and facilitate a class discussion.

– Vocabulary Pictionary

Instructions: Provide the students with a list of vocabulary words from the article, such as “confidante,” “valuation,” “successor,” and “legacy.” Divide the class into pairs or small groups and have them take turns drawing pictures to represent the meanings of the words. The other students in the group must guess the word based on the drawing. This activity will help reinforce their understanding of the vocabulary used in the article.

– Pros and Cons

Instructions: Divide the class into two groups and assign one group to come up with the pros of Charlie Munger’s contributions to Berkshire Hathaway and the other group to come up with the cons. Give them a few minutes to brainstorm and then have each group present their arguments to the class. Encourage students to build on each other’s points and engage in a respectful debate.

– Future Predictions

Instructions: In pairs or small groups, have the students discuss and make predictions about the future of Berkshire Hathaway without Charlie Munger. They should consider factors such as leadership transition, potential changes in investment strategies, and the impact on the company’s market value. After the discussion, each group can share their predictions with the class and explain their reasoning.

Comprehension Questions:

1. Who is Charlie Munger and what was his role at Berkshire Hathaway?

2. How did Charlie Munger contribute to the success of Berkshire Hathaway?

3. What did Charlie Munger often do when he saw mistakes?

4. How did Warren Buffett describe Charlie Munger’s role in building Berkshire Hathaway?

5. What was Charlie Munger known for in terms of investment strategy?

6. How does Charlie Munger’s fortune compare to Warren Buffett’s fortune?

7. Who has been named as Warren Buffett’s successor at Berkshire Hathaway?

8. How have various figures in the business world paid tribute to Charlie Munger?

Go to answers ⇩

Listen and Fill in the Gaps:

Tributes are (1)______ in for Charlie Munger, the trusted (2)______ of renowned investor Warren Buffett, who passed away at the age of 99. Munger, who would have turned 100 on (3)______ 1st, had been a vice chairman at Berkshire Hathaway since 1978. Buffett credits Munger with being instrumental in building Berkshire Hathaway into the successful investment company it is today, with a market valuation of $785 billion. Munger was (4)______ for his straightforward and honest approach, often pointing out mistakes when he saw them. His passing (5)______ shortly after Buffett (6)______ a significant amount of Berkshire stock to (7)______ and hinted at the possibility of stepping down in the future. Munger’s colorful quotes and (8)______ comments will be missed by shareholders at Berkshire’s annual gathering in May.

Munger’s contribution to the investment community is widely recognized, and his wisdom has benefited many. He was known for steering Buffett away from investing in mediocre companies, (9)______ to as “cigar butts,” and instead (10)______ on (11)______ investments. Munger’s fortune was (12)______ at $2.3 billion, significantly smaller than Buffett’s estimated fortune of over $100 billion. His passing marks the end of an era for Berkshire Hathaway, but the company has already named Greg Abel as Buffett’s successor.

Tributes have come from various figures in the business world, including Tim Cook, CEO of Apple, who described (13)______ as a “titan of business” and (14)______ his role in building an American institution. Brian Moynihan, CEO of Bank of America, also acknowledged Munger’s (15)______ status in the investment community and the significant impact he had on others. Munger’s legacy will continue to be remembered and celebrated by those who were influenced by his wisdom and (16)______.

Go to answers ⇩

Discussion Questions:

Students can ask a partner these questions, or discuss them as a group.

1. What do you think makes someone a “trusted confidante”?

2. How do you think Charlie Munger’s straightforward and honest approach contributed to Berkshire Hathaway’s success?

3. Do you think it’s important for successful investors to point out mistakes when they see them? Why or why not?

4. How do you think Warren Buffett’s donation of Berkshire stock to charity reflects on his leadership and legacy?

5. Why do you think Warren Buffett hinted at the possibility of stepping down in the future?

6. What qualities do you think make a company successful in the investment community?

7. How do you think Charlie Munger’s role in steering Buffett away from mediocre companies impacted Berkshire Hathaway’s success?

8. Do you think it’s important for successful business leaders to leave a legacy? Why or why not?

9. How do you think Charlie Munger’s wisdom and insights influenced others in the investment community?

10. What do you think it means to be a “titan of business”?

11. How do you think Charlie Munger’s passing marks the end of an era for Berkshire Hathaway?

12. Do you think it’s important for successful business leaders to name successors? Why or why not?

13. How do you think Charlie Munger’s legacy will continue to be remembered and celebrated?

14. Have you ever been influenced by someone’s wisdom and insights? Can you give an example?

15. What do you think is the most important lesson we can learn from Charlie Munger’s life and career?

Individual Activities

Vocabulary Meanings:

Match each word to its meaning.

Words:

1. Charlie

2. Munger

3. Buffett

4. Berkshire

5. Hathaway

6. investment

7. company

8. valuation

Meanings:

(a) The contribution Munger made to the investment community

(b) The successful investment company with a market valuation of $785 billion

(c) The successor to Buffett at Berkshire Hathaway

(d) The estimated fortune of Munger

(e) The vice chairman at Berkshire Hathaway since 1978

(f) The person who passed away at the age of 99

(g) The trusted confidante of renowned investor Warren Buffett

(h) The renowned investor who credited Munger with building Berkshire Hathaway

Go to answers ⇩

Multiple Choice Questions:

1. Who was Charlie Munger a trusted confidante of?

(a) Tim Cook

(b) Warren Buffett

(c) Brian Moynihan

(d) Greg Abel

2. How old would Charlie Munger have been on January 1st?

(a) 100

(b) 98

(c) 101

(d) 99

3. When did Charlie Munger become a vice chairman at Berkshire Hathaway?

(a) 1985

(b) 1992

(c) 2001

(d) 1978

4. What is the market valuation of Berkshire Hathaway?

(a) $100 billion

(b) $2.3 billion

(c) $1 trillion

(d) $785 billion

5. What did Charlie Munger often point out when he saw them?

(a) Successes

(b) Opportunities

(c) Mistakes

(d) Challenges

6. Who donated a significant amount of Berkshire stock to charity?

(a) Charlie Munger

(b) Warren Buffett

(c) Tim Cook

(d) Brian Moynihan

7. Who has been named as Buffett’s successor at Berkshire Hathaway?

(a) Tim Cook

(b) Brian Moynihan

(c) Greg Abel

(d) Charlie Munger

8. Who described Charlie Munger as a “titan of business”?

(a) Tim Cook

(b) Brian Moynihan

(c) Warren Buffett

(d) Greg Abel

Go to answers ⇩

True or False Questions:

1. Warren Buffett credits Munger with being instrumental in building Berkshire Hathaway into a successful investment company.

2. Berkshire Hathaway has a market valuation of $785 billion.

3. Munger had been a janitor at Berkshire Hathaway since 1978.

4. Munger’s promotion comes shortly after Buffett’s greedy donation and hint at retirement.

5. Charlie Munger, the trusted confidante of Warren Buffett, has passed away at the age of 99.

6. Buffett recently donated an insignificant amount of Berkshire stock to charity and hinted at the impossibility of stepping down in the future.

7. Munger’s colorful quotes and candid comments will be missed by shareholders at Berkshire’s annual gathering in May.

8. Munger was known for his misleading and dishonest approach, often hiding mistakes when he saw them.

Go to answers ⇩

Write a Summary:

Write a summary of this news article in two sentences.

Check your writing now with the best free AI for English writing!

Writing Questions:

Answer the following questions. Write as much as you can for each answer.

Check your answers with our free English writing assistant!

1. How long had Charlie Munger been a vice chairman at Berkshire Hathaway?

2. How did Charlie Munger contribute to building Berkshire Hathaway into a successful investment company?

3. How did Charlie Munger’s fortune compare to Warren Buffett’s fortune?

4. Who has paid tribute to Charlie Munger and what did they say about him?

5. How will Charlie Munger’s legacy be remembered and celebrated?

Answers

Comprehension Question Answers:

1. Who is Charlie Munger and what was his role at Berkshire Hathaway?

Charlie Munger was a trusted confidante of renowned investor Warren Buffett and served as a vice chairman at Berkshire Hathaway since 1978.

2. How did Charlie Munger contribute to the success of Berkshire Hathaway?

Charlie Munger was instrumental in building Berkshire Hathaway into the successful investment company it is today, with a market valuation of $785 billion.

3. What did Charlie Munger often do when he saw mistakes?

Charlie Munger often pointed out mistakes when he saw them, taking a straightforward and honest approach.

4. How did Warren Buffett describe Charlie Munger’s role in building Berkshire Hathaway?

Warren Buffett credited Charlie Munger with being instrumental in building Berkshire Hathaway into the successful investment company it is today.

5. What was Charlie Munger known for in terms of investment strategy?

Charlie Munger was known for steering Warren Buffett away from investing in mediocre companies, referred to as “cigar butts,” and instead focusing on quality investments.

6. How does Charlie Munger’s fortune compare to Warren Buffett’s fortune?

Charlie Munger’s fortune was estimated at $2.3 billion, significantly smaller than Warren Buffett’s estimated fortune of over $100 billion.

7. Who has been named as Warren Buffett’s successor at Berkshire Hathaway?

Greg Abel has been named as Warren Buffett’s successor at Berkshire Hathaway.

8. How have various figures in the business world paid tribute to Charlie Munger?

Various figures in the business world, including Tim Cook and Brian Moynihan, have praised Charlie Munger’s role in building an American institution and acknowledged his legendary status in the investment community.

Go back to questions ⇧

Listen and Fill in the Gaps Answers:

(1) pouring

(2) confidante

(3) January

(4) known

(5) comes

(6) donated

(7) charity

(8) candid

(9) referred

(10) focusing

(11) quality

(12) estimated

(13) Munger

(14) praised

(15) legendary

(16) insights

Go back to questions ⇧

Vocabulary Meanings Answers:

1. Charlie

Answer: (g) The trusted confidante of renowned investor Warren Buffett

2. Munger

Answer: (f) The person who passed away at the age of 99

3. Buffett

Answer: (h) The renowned investor who credited Munger with building Berkshire Hathaway

4. Berkshire

Answer: (e) The vice chairman at Berkshire Hathaway since 1978

5. Hathaway

Answer: (b) The successful investment company with a market valuation of $785 billion

6. investment

Answer: (a) The contribution Munger made to the investment community

7. company

Answer: (d) The estimated fortune of Munger

8. valuation

Answer: (c) The successor to Buffett at Berkshire Hathaway

Go back to questions ⇧

Multiple Choice Answers:

1. Who was Charlie Munger a trusted confidante of?

Answer: (b) Warren Buffett

2. How old would Charlie Munger have been on January 1st?

Answer: (a) 100

3. When did Charlie Munger become a vice chairman at Berkshire Hathaway?

Answer: (d) 1978

4. What is the market valuation of Berkshire Hathaway?

Answer: (d) $785 billion

5. What did Charlie Munger often point out when he saw them?

Answer: (c) Mistakes

6. Who donated a significant amount of Berkshire stock to charity?

Answer: (b) Warren Buffett

7. Who has been named as Buffett’s successor at Berkshire Hathaway?

Answer: (c) Greg Abel

8. Who described Charlie Munger as a “titan of business”?

Answer: (a) Tim Cook

Go back to questions ⇧

True or False Answers:

1. Warren Buffett credits Munger with being instrumental in building Berkshire Hathaway into a successful investment company. (Answer: True)

2. Berkshire Hathaway has a market valuation of $785 billion. (Answer: True)

3. Munger had been a janitor at Berkshire Hathaway since 1978. (Answer: False)

4. Munger’s promotion comes shortly after Buffett’s greedy donation and hint at retirement. (Answer: False)

5. Charlie Munger, the trusted confidante of Warren Buffett, has passed away at the age of 99. (Answer: True)

6. Buffett recently donated an insignificant amount of Berkshire stock to charity and hinted at the impossibility of stepping down in the future. (Answer: False)

7. Munger’s colorful quotes and candid comments will be missed by shareholders at Berkshire’s annual gathering in May. (Answer: True)

8. Munger was known for his misleading and dishonest approach, often hiding mistakes when he saw them. (Answer: False)

Go back to questions ⇧